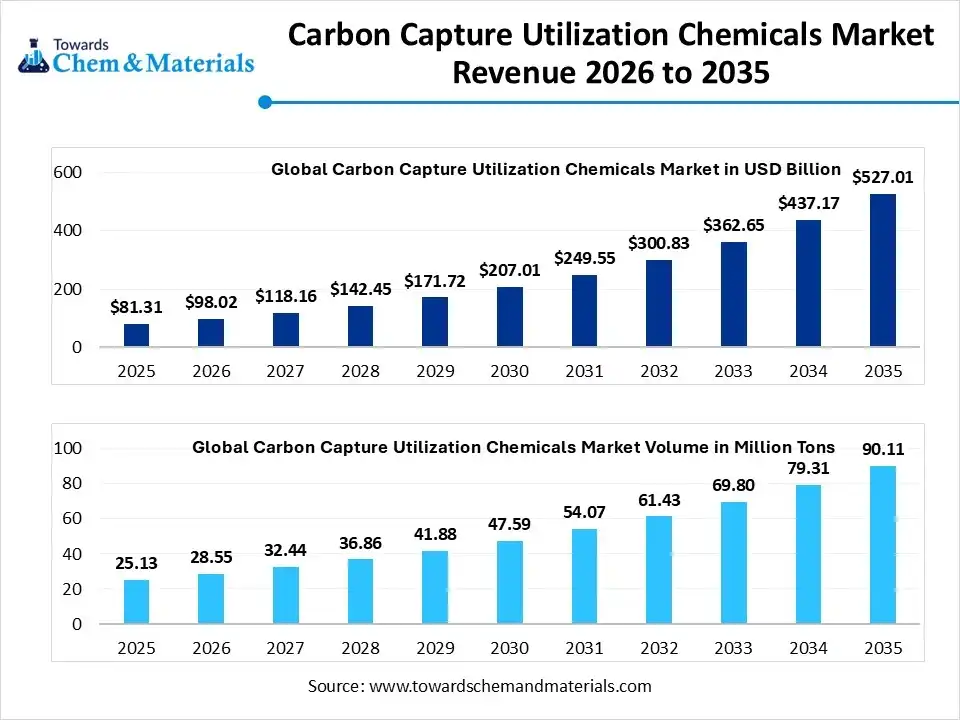

Ottawa, Jan. 23, 2026 (GLOBE NEWSWIRE) -- The global carbon capture utilization chemicals market size was estimated at USD 81.31 billion in 2025 and is expected to increase from USD 98.02 billion in 2026 to USD 527.01 billion by 2035, growing at a CAGR of 20.55%. In terms of volume, the market is projected to grow from 28.55 million tons in 2026 to 90.11 million tons by 2035. exhibiting at a compound annual growth rate (CAGR) of 13.62% over the forecast period 2026 to 2035. The Asia Pacific dominated the carbon capture utilization chemicals market with the largest volume share of 46.13% in 2025. The market is driven by a transition towards a circular carbon economy and transforming environmental liabilities into high-value industrial feedstocks. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6130

Powering a Net-Zero Future: The Essential Role of Carbon Capture Utilization Chemicals

The carbon capture utilization chemicals play a significant role in contributing to a more sustainable and net-zero future. The development and adoption of an advanced chemical framework make these processes more efficient and economically viable, turning greenhouse gas in building block for cleaner energy and decarbonization efforts.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Carbon Capture Utilization Chemicals Market Report Highlights

- Asia Pacific dominated the global capture utilization chemicals market with the largest volume share of 46.13% in 2025.

- The capture utilization chemicals market in Europe is expected to grow at a substantial CAGR of 16.64% from 2026 to 2035.

- By chemical type, the solvents segment dominated the market and accounted for the largest volume share of 55% in 2025.

- By chemical type, the adsorbents segment is expected to grow at the fastest CAGR of 18.25% from 2026 to 2035 in terms of volume.

- By capture technology, the post-combustion segment led the market with the largest revenue volume share of 58% in 2025.

- By utilization pathway, the enhanced recovery segment dominated the market and accounted for the largest volume share of 44.5% in 2025.

- By end-use industry, the power generation segment led the market with the largest revenue volume share of 38.3% in 2025.

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 98.02 Billion / 28.55 million tons |

| Revenue Forecast in 2035 | USD 527.01 Billion / 90.11 million tons |

| Growth Rate | CAGR 20.55% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Chemical Type, By Capture Technology, By Utilization Pathway, By End-Use Industry, By Region |

| Key companies profiled | Air Liquide S.A., Aker Carbon Capture ASA, Avantium N.V., BASF SE, Blue Planet Systems Corporation, Carbon Clean Solutions Ltd., Carbon Recycling International (CRI), Carbon Upcycling Technologies Inc., CarbonCure Technologies Inc., Climeworks AG, Covestro AG, Econic Technologies Ltd., LanzaTech Global, Inc., Liquid Wind AB, Mitsubishi Chemical Group Corporation, Novomer Inc., SABIC, SK Innovation Co., Ltd., Solidia Technologies, Inc., TotalEnergies SE |

Government Initiatives for Carbon Capture Utilization Chemicals:

- US Section 45Q Tax Credit: This initiative provides financial incentives for capturing carbon, with expanded credits specifically supporting the conversion of CO₂ into valuable products like chemicals and fuels.

- EU Innovation Fund: As one of the world's largest funding programs for low-carbon technologies, it provides billions in grants to industrial-scale CCU projects that produce sustainable chemical building blocks.

- India’s CCU Testbeds Initiative: The Department of Science and Technology (DST) has launched five dedicated national testbeds to foster academia-industry collaboration for converting industrial CO₂ into synthetic fuels and chemicals like soda ash and urea.

- Canada’s Carbon Management Strategy: This federal roadmap identifies CO₂-based industries as a key pathway to net-zero, offering a refundable Investment Tax Credit for projects that use captured carbon in manufacturing.

- EU Renewable Energy Directive (RED III): This regulation sets binding targets for Renewable Fuels of Non-Biological Origin (RFNBOs), incentivizing chemical producers to use captured CO₂ to manufacture synthetic e-fuels and chemicals.

- Japan’s Carbon Recycling Roadmap: This government initiative focuses on the development and commercialisation of "carbon recycling" technologies, specifically targeting the production of clean fuel ammonia and low-emission hydrogen derivatives.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6130

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

What Are the Major Trends in the Carbon Capture Utilization Chemicals Market?

- Integrated Carbon-Conversion Systems: The industrial shift towards one-vessel systems. These systems trap CO2 and convert it into fuel, bypassing intermediate steps like compression and transport.

- Stringent Government Regulations: The rising government focus on net-zero mandates that compel industries to invest in capture chemicals to lower their carbon liability.

- Electrification of Chemical Synthesis: The electrochemical reduction of CO2 replaces heat with renewable electricity for CO2 conversion, producing high-value multi-carbon products at room temperature.

Carbon Capture Utilization Chemicals Market Dynamics

Driver

Decarbonization of Hard-to-Abate Industrial Hubs

The key driver is decarbonization, where CO2 is mineralized into carbon-negative concrete and adopted by industries, including power generation and hard-to-abate sectors like cement, steel, and chemical manufacturing, that utilize capture chemicals to manufacture synthetic diesel and carbon-neutral plastics as chemical feedstock for synthetic methanol and urea.

Restraints

Public Perception and Operational Costs

The lack of knowledge in the public regarding CCU technologies hinders social acceptance, leading to a delay in adoption. Additionally, higher operation costs are driven by the substantial energy needed to capture and regenerate materials, which restrains widespread growth and commercial viability.

Opportunity

Emergence and Blue Ocean Opportunity in CCU Chemicals

In 2026, commercial scaling of Direct Air Capture (DAC) is an emerging opportunity that uses electric swings to pull CO2 from the atmosphere more efficiently. While chemical companies' initiatives in the production of sustainable aviation fuel and E-fuel, driven by tightened global aviation mandates, created a long-term market for CCU chemical output.

Beyond Storage: CCU Technological Shift Unlocks New Chemical Pathways

The technological shift shows revolutionary change where CO2 acts as a high-value feedstock by re-engineering the chemical lifecycle, such as water-lean and demixing solvents, lowering energy cost, while AI is used to rapidly screen and develop high-efficiency absorbents and novel catalysts by optimizing real-time processing to prevent costly downtime.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6130

Carbon Capture Utilization Chemicals Market Segmentation Insights

By Chemical Type Insights

How Did the Solvent Segment Dominated the Carbon Capture Utilization Chemicals Market?

The solvent segment maintains its leadership, driven by technological reliability and industrial versatility, by capturing emissions at a massive scale. The solvent provides high selectivity and thermal stability to achieve carbon capture from complex gas streams and is sustained by advanced solvent formulations. The key driver for solvent dominance is their retrofit compatibility for post-combustion capture into existing power plants.

The absorbents segment is anticipated to grow fastest due to their energy efficiency and flexibility. Solid adsorbents like metal-organic frameworks and zeolites use pressure and temperature cycles to trap and release CO2 with less energy. This is crucial for scaling direct air capture and modular units, where their high surface area and durability enable compact, cost-effective designs. Their high selectivity and stability make them ideal for reducing operational costs in modern carbon projects.

By Capture Technology Insights

Which Capture Technology Segment Dominates the Carbon Capture Utilization Chemicals Market?

The post-combustion capture segment maintains its market dominance due to its most versatile and ready solution for large-scale decarbonization. It can be retrofitted onto existing power and industrial plants, allowing fast emission mitigation. Supported by established solvents and global engineering networks, this technology ensures reliability and scalability to meet environmental regulations while safeguarding investments. As industrial clusters expand, it remains the essential bridge to a circular carbon economy.

The direct air capture (DAC) segment offers significant growth during the projected period, capable of addressing legacy emissions and atmospheric CO2. The DAC provides high-purity carbon for sustainable fuels and chemicals. Massive private investment and policy incentives drive growth, with advanced sorbents and membranes reducing energy needs. Rising demand for carbon removal credits further positions direct air capture as a key technology.

By Utilization Pathway Insights

How did Enhanced Recovery Segment Dominate the Carbon Capture Utilization Chemicals Market?

The EOR segment dominates the carbon capture utilization chemicals market mainly due to existing infrastructure and economic incentives. Using captured CO2 for EOR in developed oil fields boosts oil production and offsets capture costs. Established pipelines and geological knowledge from oil and gas extraction further support CO2-EOR, maintaining its market leadership.

The fuel synthesis segment is set to experience the fastest growth, aiming at the decarbonization of transportation and aviation. Combining captured CO2 with green hydrogen creates high-energy e-fuels like synthetic kerosene and methanol for industries where electrification is difficult. Innovations in catalysts and reactors improve efficiency and lower costs, turning emissions into valuable energy carriers and supporting a circular carbon economy.

End-Use Industry Insights

Why did the Power Generation Segment dominate the Carbon Capture Utilization Chemicals Market?

Power generation remains the leading driver for carbon capture demand, ensuring energy security during the transition. Utilities retrofit coal and gas plants to provide reliable baseload power, balancing variable renewables. The high-volume emissions from this sector enable efficient use of chemicals and serve as a testing ground for commercial deployment, creating the infrastructure for a low-carbon grid.

The chemical & petrochemical segment is experiencing the fastest growth in the market during the projected period. Because it can reuse CO2 as a feedstock. They are adopting advanced catalysts and reactors to turn captured emissions into high-value products like polyols, ethylene, and green methanol. Driven by a shift to circular chemistry and global demand for sustainable materials, this industry is transforming emissions into a competitive advantage and sustainable growth.

Regional Insights

How did Asia Pacific Dominate the Carbon Capture Utilization Chemicals Market?

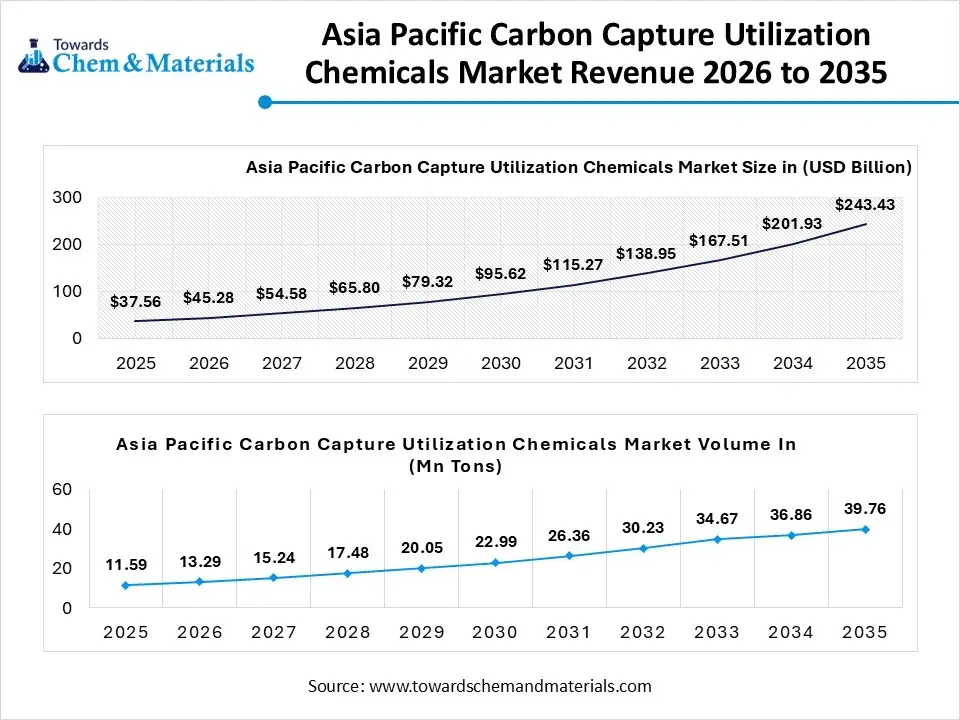

The global Asia Pacific carbon capture utilization chemicals market was estimated to be USD 37.56 billion in 2025 and is projected to reach USD 243.43 billion by 2035, at a CAGR of 20.57% during the forecast period. By volume, the market is projected to grow from 13.29 million tons in 2026 to 39.76 million tons in 2035. growing at a CAGR of 16.68% from 2026 to 2035.

Dominance in the Asia-Pacific carbon capture market is often achieved through integrating large industrial clusters that co-locate high-emission facilities with advanced conversion plants. By adopting a circular carbon strategy, industrial leaders treat carbon as a raw material for the petrochemical and manufacturing sectors, supported by innovations in catalysts and amine-based solvents used across steel, cement, and power plants. A shift toward using captured emissions for sustainable methanol and urea fosters a self-sustaining market, reducing costs and accelerating decarbonization goals globally.

China Carbon Capture Utilization Chemicals Market Trends

China’s market is expanding rapidly as CCU technologies move from pilot phases towards commercial-scale deployment, driven by the country's aggressive “dual carbon” targets and supportive policy environment that includes subsidies and integration into carbon trading mechanisms. Key CCU applications in China focus on converting captured CO₂ into valuable chemicals such as methanol, formic acid, and other feedstocks, helping to create new revenue streams while reducing emissions.

Why is North America the Fastest-Growing Region in the Carbon Capture Utilization Chemicals Industry?

North America's rapid growth is driven by aggressive federal policies and advanced infrastructure, including tax incentives for captured and used carbon, enabling higher profitability for large projects. The region is transitioning to commercial facilities converting emissions into synthetic fuels, high-value materials, and green polymers. An established pipeline network and geological expertise further reduce operational costs, with incentives and private investments reinforcing North America's role as a leading growth engine in the global market.

U.S. Carbon Capture Utilization Chemicals Market Trends

The U.S. market is expanding as projects move from pilot stages towards commercial-scale production of CO₂-derived chemicals such as methanol, formic acid, and specialty intermediates. Strong government incentives and policy support, including federal tax credits and funding programs, are improving project economics and accelerating adoption.

More Insights in Towards Chemical and Materials:

- PAN-based Carbon Fiber Market Size to Hit USD 10.16 Bn by 2035

- Standard Modulus Carbon Fiber Market Size to Hit USD 7.56 Bn by 2035

- Propylene Carbonate Market Size to Hit USD 782.56 Million by 2035

- North America Calcium Carbonate Market Size to Hit USD 25.52 Bn by 2035

- Chemical Decarbonization Market Size to Surpass USD 665.56 Bn by 2035

- Advanced Carbon Materials Market Size to Hit USD 86.27 Bn by 2035

- Low-Carbon Construction Material Market Size to Hit USD 601.63 Bn by 2034

- Carbon Black Market Size to Surpass USD 44.77 Billion by 2034

- Carbon Fiber Reinforced Plastic (CFRP) Market Size to Surge USD 48.08 Bn by 2034

- Carbon Steel Market Size to Surpass USD 1,802.47 Billion by 2035

- Bio-based Polycarbonate Market Size to Reach USD 80.97 Million in 2025

- Specialty Carbon Black Market Size to Reach USD 8.54 Billion by 2034

- Steel Wire Rope Market Size to Hit USD 19.79 Bn by 2035

- PET Film-Coated Steel Coil Market Size to Hit USD 46.99 Bn by 2035

- Iron and Steel Casting Market Size to Hit USD 320.07 Bn by 2035

- Stainless Steel Powder Market Size to Hit USD 1,432.39 Mn by 2035

- Alloy Steel Market Size to Hit USD 170.97 Billion by 2035

- Stainless Steel-Filled Polymer Filaments Market Size to Hit USD 157.82 Mn by 2035

- Steel Market Size to Reach USD 2.66 Trillion by 2035

- Iron and Steel Market Size to Hit USD 2.95 Trillion by 2035

- Steel Rebar Market Size to Reach USD 426.51 Billion by 2034

- U.S. Steel Rebar Market Size to Exceed USD 11.59 Billion by 2034

- Stainless Steel Market Size to Surge USD 357.28 Billion by 2034

- Flat Steel Market Size to Hit USD 1,157.84 Billion by 2034

- Vinyl Acetate Monomer (VAM) Market Size to Hit USD 22.65 Billion by 2035

Recent Developments in Carbon Capture Utilization Chemicals Industry:

- In June 2025, Mitsubishi Gas Chemical Company and the Research Institute of Innovative Technology for Earth announce strategic partnership that focuses on technological advancement to capture CO2 from the air and utilize it. The device is designed for transferring CO2 recovered using a direct-air-capture device at the Osaka-Kansai Expo.

https://www.mgc.co.jp/eng/corporate/news/2025/250616e.html

Top Market Players in Carbon Capture Utilization Chemicals Market & Their Offerings:

Tier 1:

- Ecolab Inc. (Nalco): Supplies colloidal silica binders and specialty chemicals essential for manufacturing carbon-capturing zeolites and catalysts.

- BASF SE: Offers the OASE® blue amine-based solvent technology for high-efficiency CO2 recovery from industrial flue gases.

- Solvay S.A.: Utilizes captured CO2 as a feedstock for sustainable soda ash production and develops electrochemical capture solutions.

- Air Products and Chemicals, Inc.: Provides large-scale membrane and adsorption systems to capture CO2 from hydrogen and syngas production streams.

- Tosoh Corporation: Produces high-performance zeolite adsorbents engineered for selective CO2 separation in diverse gas mixtures.

- Honeywell International Inc. (UOP): Markets modular carbon capture units and advanced solvent technologies designed for rapid industrial deployment.

- Zeochem AG: Specializes in molecular sieve adsorbents that physically trap CO2 molecules during the gas purification process.

- Mitsubishi Chemical Group Corporation: Develops specialized resins and chemical intermediates that enable the conversion of captured CO2 into commercial products.

Tier 2:

- Huntsman Corporation

- INEOS Group

- Occidental Petroleum Corporation (OxyChem)

- Westlake Corporation

- Formosa Plastics Corporation

- Yara International ASA

- CF Industries Holdings, Inc.

- Nutrien Ltd.

- Graymont Limited

- Carmeuse

- Wacker Chemie AG

- Dow Inc.

Carbon Capture Utilization Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Carbon Capture Utilization Chemicals Market

By Chemical Type

- Solvents (Liquid Phase)

- Amine-based Chemicals

- Monoethanolamine (MEA)

- Methyldiethanolamine (MDEA)

- Diethanolamine (DEA)

- Piperazine (PZ)

- Sterically Hindered Amines

- Alkaline-based Chemicals

- Sodium Hydroxide (NaOH)

- Potassium Hydroxide (KOH)

- Sodium Carbonate

- Potassium Carbonate

- Ammonia-based Solutions

- Ionic Liquids

- Amine-based Chemicals

- Adsorbents (Solid Phase)

- Zeolites (Molecular Sieves)

- Metal-Organic Frameworks (MOFs)

- Activated Carbon

- Silica Gel

- Alumina-based Adsorbents

- Catalysts (Utilization Phase)

- Hydrogenation Catalysts (Copper/Zinc-based)

- Electrochemical Catalysts

- Carbonation Catalysts

- Biological/Enzymatic Catalysts

By Capture Technology

- Post-combustion Capture

- Pre-combustion Capture

- Oxy-fuel Combustion Capture

- Direct Air Capture (DAC)

By Utilization Pathway

- Chemical Synthesis

- Methanol Production

- Urea Production

- Polymer & Plastic Synthesis

- Organic Acid Production (Formic, Acetic)

- Fuel Synthesis

- Synthetic Natural Gas (Methane)

- Aviation e-Fuels

- Diesel Replacements

- Mineralization & Construction

- CO2-cured Concrete

- Aggregates Production

- Pre-cast Building Materials

- Biological Utilization

- Algae-based Biomass

- Greenhouse Enrichment

- Enhanced Recovery

- Enhanced Oil Recovery (EOR)

- Enhanced Gas Recovery (EGR)

By End-Use Industry

- Oil & Gas

- Power Generation

- Chemical & Petrochemical

- Iron & Steel

- Cement & Lime

- Pulp & Paper

- Food & Beverage

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6130

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/