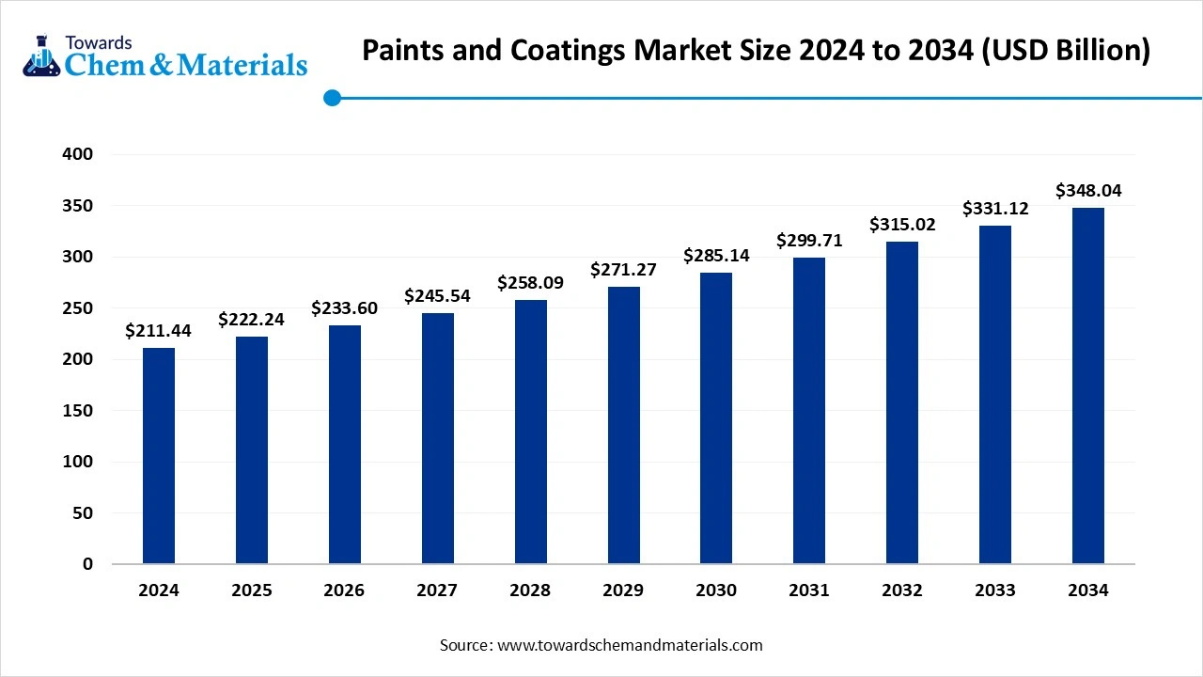

Ottawa, Dec. 04, 2025 (GLOBE NEWSWIRE) -- The global paints and coatings market size reached at USD 222.24 billion in 2025 and is predicted to increase by USD 233.60 billion in 2026 and is expected to be worth around USD 348.04 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 5.11% over the forecast period 2025 to 2034. Asia Pacific dominated the paints and coatings market with a market share of 47% in 2024. The growth of the paints and coatings market is being driven by rising construction activities across residential, commercial, and industrial sectors, as well as growing demand for automotive and transportation coatings.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5933

What are Paints and Coatings?

The global paints and coatings market is experiencing robust growth, driven by increasing construction, automotive, and industrial activities worldwide. Decorative paints remain a major segment, fueled by rising consumer demand for aesthetic and durable finishes in residential and commercial spaces. Protective and functional coatings, including anti-corrosive, heat-resistant, and water-repellent formulations, are gaining traction across industrial and infrastructure applications.

Sustainability trends and stricter environmental regulations are accelerating the adoption of eco-friendly, low-VOC, and water-based coatings. Technological advancements in smart coatings, nanocoatings, and powder coatings are further enhancing performance and broadening applications.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Paints and Coatings Market Report Highlights

- Asia Pacific dominated the paints and coatings market with the largest revenue share of 47% in 2024.

- By resin type, the acrylic segment led the market with the largest revenue share of 47.5% in 2024.

- By technology, the water-based segment led the market with the largest revenue share of 41.3% in 2024.

- By application, the architectural coatings segment dominated the market in terms of revenue, accounting for a 48.97% share in 2024.

- By end-use industry, the construction segment led the market with the largest revenue share of 50% in 2024.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5933

The 2025 Top Companies Report

Top manufacturers of paints, coatings, adhesives, and sealants

| RANK | LOGO | COMPANY | LOCATION | SALES |

| 1 |  | Sherwin-Williams | 101 Prospect Ave Nw, Cleveland, OH, 44115 USA | $18.4 Billion |

| 2 |  | PPG Industries | One Ppg Pl 40 East, Pittsburgh, Pennsylvania, 15272 USA | $15.8 Billion |

| 3 |  | AkzoNobel | Christian Neefestraat 2, 1077 WW Amsterdam, Netherlands | $11.2 Billion |

| 4 |  | Nippon Paint Holding Co., Ltd | 20 Pasir Panjang Road (West), #13-26 Mapletree Business City, Singapore 117439 China | $10.4 Billion |

| 5 |  | RPM International Inc | 2628 Pearl Road, Medina, OH 44256 USA | $7.3 Billion |

| 6 |  | Axalta Coating Systems | 1050 Constitution Ave. Philadelphia, PA 19112 USA | $5.3 Billion |

| 7 |  | BASF Coatings | Carl-Bosch-Straße 38, 67056 Ludwigshafen am Rhein, Rheinland-Pfalz, Germany. | $5 Billion |

| 8 |  | Asian Paints Limited | sian Paints House 6A & 6B, Shantinagar, Santacruz (E), Mumbai - 400 055, India | $4 Billion |

| 9 |  | Kansai Paint Co., Ltd | 28th Floor, Osaka Umeda Twin Towers South, 1-13-1 Umeda, kita-ku, Osaka, 530-0001, Japan | $3.8 Billion |

Uses of Paints and Coatings Market

Paint: Paint is often used in residential, commercial, and strata buildings for interior and exterior walls and ceilings. It is also used to decorate furniture, doors, and windows. The most important fact is that you can paint over coatings but can’t apply coatings over paint.

Coatings: Coatings are used mostly in industrial buildings like garages, shopping malls, and warehouses. They can also be used on cars, appliances, bridges, and pipes where protection is required to save the property from wear and tear.

Purpose

Paint: Painting mainly enhances the beauty of any structure. Its main purpose is to make any property look appealing or aesthetic. Though it can provide some level of protection, it’s not the main goal. Paint is used only for decorative purposes to make old buildings newer and nicer.

Coatings: The coating scenario is different. It has a wide range of purposes. Coatings can also add decoration to the property, but the main purpose is to give protection and perform for a long time. The functions coatings can do include rust and corrosion protection, stability in ultra-violate rays, colour retention, protection against mould, mildew and bacteria, waterproofing, water shading, etc. Coatings can also be fire and chemical-resistant.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5933

Paints And Coatings Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 233.60 Billion |

| Revenue forecast in 2034 | USD 348.04 Billion |

| Growth rate | CAGR of 5.11% from 2025 to 2034 |

| Base year for estimation | 2025 |

| Historical data | 2018 - 2025 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

| Segments covered | By Resin Type, By Technology, By Application, By End-Use Industry, By Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Costa Rica; Saudi Arabia; South Africa. |

| Key companies profiled | Jotun; The Sherwin-Williams Company; Axalta Coating Systems; PPG Industries, Inc.; RPM INTERNATIONAL, INC.; BASF SE; Henkel AG & Company, KGaA; Contego International Inc.; Hempel A/S; No-Burn Inc.; Nullifire; 3M; Albi Protective Coatings; Akzo Nobel N.V. |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

U.S. Paints & Coatings Market Size and Growth 2025 to 2034

The U.S. paints and coatings market size is estimated at USD 33.65 billion in 2025 and is anticipated to reach USD 50.23 billion by 2034, growing at a CAGR of 7.35% from 2025 to 2034. This growth is attributed to the increasing construction activities and urbanization as primary contributors, boosting demand for residential and commercial coatings. In addition, the automotive sector's expansion also plays a significant role, necessitating advanced coatings for durability and aesthetics. Furthermore, a rising consumer preference for eco-friendly products, such as low-VOC and sustainable coatings, aligns with regulatory trends and environmental concerns, driving the market’s growth

Immediate Delivery Available | Buy This Premium Research Report ( Single Region

USD 3200) https://www.towardschemandmaterials.com/checkout/5819

AI Transforming the Paints and Coatings Industry: Smarter, Sustainable, and High-Performance Solutions

AI is revolutionizing the paints and coatings industry by enabling faster product development and optimized formulations tailored to specific applications. Machine learning algorithms analyze vast datasets to predict color trends, durability, and chemical interactions, reducing trial-and-error experimentation. In manufacturing, AI-driven automation and process optimization enhance production efficiency, minimize waste, and improve quality control. Predictive maintenance powered by AI ensures coating equipment operates at peak performance, reducing downtime and operational costs.

Private Industry Investments for the Paints and Coatings:

- Blackstone's potential acquisition of Akzo Nobel India: This investment involves the global private equity firm Blackstone expressing interest in acquiring a controlling stake in the Indian operations of Dutch multinational Akzo Nobel.

- Lone Star Funds' sale of AOC: Private equity firm Lone Star Funds completed the sale of AOC, a global supplier of specialty formulations for coatings, to Nippon Paint Holdings.

- MPE Partners' investment in LA-CO Industries: MPE Partners, another private equity firm, made an unattributed investment in LA-CO Industries, a company that provides coatings and other related products.

- Brahm's investment in Suprabha Protective Products: Private investor Brahm provided a $10.9 million funding round to Suprabha Protective Products, a manufacturer of protective packaging materials.

- Peak XV Partners' investment in Indigo Paints: Venture capital firm Peak XV Partners made multiple private investments in Indigo Paints, a fast-growing Indian paint manufacturer, prior to its IPO.

Key Trends of the Paints and Coatings Market

- Shift Toward Eco-Friendly and Sustainable Coatings

Driven by stringent environmental regulations and growing consumer awareness, the industry is seeing a significant transition from solvent-based products to water-based and powder coatings. These new formulations minimize volatile organic compounds (VOCs) and hazardous chemicals, improving indoor air quality and reducing environmental impact. - Innovation in High-Performance and Smart Coatings

Manufacturers are developing advanced coatings with enhanced functionality, such as self-healing, anti-bacterial, and heat-reflective properties. These innovations not only offer improved durability and protection against wear, corrosion, and extreme temperatures but also contribute to energy efficiency and reduced maintenance costs across various applications, including automotive and construction.

Market Opportunity

Eco-Friendly and Low-VOC Coatings: The Green Frontier in Paints and Coatings

A major opportunity in the paints and coatings market lies in the rising demand for eco-friendly, low-VOC, and water-based formulations. Increasing environmental regulations, government initiatives, and consumer awareness are driving a shift away from traditional solvent-based paints toward sustainable alternatives. These coatings not only reduce harmful emissions but also enhance indoor air quality and comply with green building standards. Technological advancements are enabling manufacturers to develop high-performance, durable, and aesthetically appealing, eco-friendly coatings.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5933

Paints and Coatings Market Segmentation Insights

Resin Type Insights

In 2024, the acrylic segment led the market due to its excellent durability, weather resistance, and versatility across various applications. Acrylic coatings are widely used in residential, commercial, and industrial construction because they provide long-lasting color retention, crack resistance, and protection against UV exposure and moisture. Their compatibility with both water-based and solvent-based formulations enhances ease of application and reduces maintenance requirements.

The epoxy segment is growing fastest over the forecast period due to its superior chemical resistance, adhesion, and durability, making it ideal for industrial, automotive, and protective applications. Epoxy coatings provide long-lasting protection against corrosion, abrasion, and moisture, which is critical for infrastructure, pipelines, and heavy machinery. Their excellent bonding properties allow them to adhere effectively to metals, concrete, and other substrates, enhancing structural longevity.

Technology Insights

In 2024, the water-based segment led the market due to increasing environmental regulations and growing consumer preference for eco-friendly, low-VOC, and low-odor solutions. Water-based coatings offer excellent ease of application, faster drying times, and reduced hazardous emissions compared to solvent-based alternatives. Their versatility allows use across residential, commercial, and industrial projects, including decorative, protective, and specialty applications.

The UV-cured coatings segment is growing fastest over the forecast period due to its rapid curing time, high durability, and superior chemical and scratch resistance, making it ideal for industrial, automotive, and wood-finishing applications. These coatings enable faster production cycles, reduce energy consumption, and minimize volatile organic compound (VOC) emissions, aligning with sustainability and environmental regulations. UV-cured formulations also provide excellent adhesion, gloss, and surface hardness, enhancing aesthetic appeal and functional performance.

Application Insights

The architectural coatings segment led the market in 2024 due to strong demand from residential, commercial, and institutional construction projects. Rising urbanization, home renovations, and new infrastructure developments fueled the need for decorative and protective coatings that enhance aesthetics and durability. Architectural coatings, including interior and exterior paints, offer easy application, long-lasting color retention, and resistance to weathering and environmental damage, making them highly preferred by builders and homeowners.

The automotive coatings segment is growing fastest over the forecast period due to increasing vehicle production, rising demand for durable and aesthetically appealing finishes, and the expansion of the automotive aftermarket. Automotive coatings provide superior protection against corrosion, UV radiation, chemicals, and scratches, ensuring vehicle longevity and enhanced appearance. Growing adoption of eco-friendly, waterborne, and low-VOC coatings aligned with stringent environmental regulations, further accelerating market growth.

End-use Industry Insights

The construction segment led the market in 2024 due to strong growth in residential, commercial, and infrastructure projects worldwide. Rising urbanization, increasing disposable incomes, and expanding middle-class populations drove demand for decorative, protective, and specialty coatings in buildings. Construction coatings offer durability, weather resistance, and aesthetic appeal, making them essential for both interior and exterior applications.

The automotive segment is expected to lead the market over the forecast period due to rising global vehicle production, increasing consumer demand for high-quality finishes, and the need for long-lasting protection against corrosion, UV exposure, and environmental damage. Advanced automotive coatings, including waterborne, low-VOC, metallic, and pearlescent formulations, enhanced both durability and aesthetic appeal, aligning with stricter environmental regulations.

Regional Insights

Asia Pacific: The Dominant Force in the Global Paints and Coatings Market

The Asia Pacific paints and coatings market size is estimated at USD 104.45 billion in 2025 and is projected to reach USD 348.04 billion by 2034, growing at a CAGR of 5.11% from 2025 to 2034. Asia Pacific dominated the market with a share of approximately 47% in 2024.

Asia Pacific dominates the global market due to rapid urbanization, booming construction activities, and a growing automotive sector in countries like China, India, and Japan. Rising demand for decorative, protective, and industrial coatings is driven by expanding residential, commercial, and infrastructure projects. The region’s industrialization and increasing consumer spending are fueling the adoption of high-performance and specialty coatings. Government initiatives promoting green building standards and environmental compliance are accelerating the shift toward low-VOC and eco-friendly coatings.

China Paints and Coatings Market Trends

China’s market is experiencing robust growth, driven by rapid urbanization, infrastructure development, and expansion in the automotive and industrial sectors. Rising demand for decorative paints in residential and commercial construction is complemented by growing adoption of protective and high-performance coatings for industrial applications. Stricter environmental regulations and increased awareness of sustainability are accelerating the shift toward low-VOC, water-based, and eco-friendly coatings.

North America: The Fastest-Growing Hub for Advanced Paints and Coatings

North America is witnessing the fastest growth in the market, driven by strong demand for high-performance, sustainable, and specialty coatings across automotive, construction, and industrial sectors. Rising adoption of eco-friendly, low-VOC, and water-based paints is fueled by stringent environmental regulations and growing consumer awareness. Infrastructure modernization, urban redevelopment projects, and expansion of the residential and commercial construction segments are boosting coating consumption.

Canada Paints and Coatings Market Trends

Canada’s market is growing steadily, driven by increased construction activities in residential, commercial, and industrial sectors. Rising demand for decorative, protective, and specialty coatings is fueled by urban development, infrastructure projects, and remodeling trends. Environmental regulations and sustainability initiatives are accelerating the adoption of low-VOC, water-based, and eco-friendly coatings. Technological advancements, including high-performance, durable, and smart coatings, are expanding applications across automotive, industrial, and construction segments.

Top Companies in the Paints and Coatings Market & Their Offerings:

- Sherwin-Williams: A leader in manufacturing and distributing paints and coatings globally through extensive retail and professional networks.

- PPG Industries: A global supplier of paints, coatings, and specialty materials for industrial, construction, and transportation sectors.

- AkzoNobel: A Dutch company creating paints and performance coatings for global industry and consumers, known for major brands like Dulux.

- BASF SE: Offers automotive OEM and refinish coatings, as well as surface treatments and decorative paints within its vast chemical portfolio.

- Axalta Coating Systems: A global provider focused exclusively on performance and transportation coatings for various industrial and automotive applications.

- RPM International Inc.: A holding company specializing in high-performance specialty coatings, sealants, and building materials for industrial and consumer use.

- Nippon Paint Holdings: A leading Asian paint manufacturer with a global presence, supplying automotive, marine, and architectural coatings.

- Kansai Paint Co., Ltd.: A major Japanese manufacturer providing a wide array of coatings products for automotive, industrial, and decorative markets.

- Jotun Group: A Norwegian global producer of paints and powder coatings, specializing in decorative, marine, protective, and industrial solutions.

More Insights in Towards Chemical and Materials:

- Green Coatings Market Size to Surpass USD 145.19 Billion by 2035

- Powder Coatings Market Size to Boosts USD 18.26 Bn in 2025

- Concrete Floor Coatings Market Size Leads USD 8.53 Bn By 2034

- Pipe Coatings Market Leads USD 16.84 Bn at 5.40% CAGR

- Nanocoatings Market Size to Reach USD 20.10 Bn in 2025

- Self-Healing Coatings Market Leads USD 39.16 Bn at 28.42% CAGR

- Liquid Paints & Coatings Market Size to Surge USD 246.39 Bn by 2035

- Automotive Paints & Coatings Market Size to Hit USD 48.22 Bn by 2035

- Water-Based Solvent Paints Market Size to Surpass USD 153.39 Bn by 2035

- Paints and Coatings Market Size to Hit USD 348.04 Bn by 2034

- European Paints & Coatings Market Size to Hit USD 54.27 Bn by 2034

- U.S. Paints & Coatings Market Size to Reach USD 50.23 Billion by 2034

- Epoxy Paint Thinner Market Size to Reach USD 42.43 Million by 2034

- Refinish Paint Market Size to Boom USD 9.21 Bn in 2025

- Paint Protection Film Market Size to Boom USD 926.81 Mn By 2034

- Cement Paints Market Hits USD 8.11 Bn at 3.25% CAGR [2025-34]

- Biopolymer Coatings Market Size to Reach USD 109.08 Bn by 2035

- Industrial Coatings Market Size to Hit USD 176.06 Bn by 2035

- Automotive OEM Coatings Market Size to Reach USD 25.25 Billion by 2034

- U.S. Conformal Coatings Market Size to Surge USD 3.16 Billion by 2034

- U.S. Powder Coatings Market Size to Hit USD 11.65 Billion by 2034

- U.S. Mirror Coatings Market Size to Surge USD 304.83 Million by 2034

- European Paints & Coatings Market Size to Hit USD 54.27 Bn by 2034

- U.S. Industrial Coatings Market Size to Hit USD 38.81 Bn by 2034

- Sustained Release Coatings Market Size to Hit USD 1,373.63 Mn by 2034

- Low-VOC Coatings Market Size to Reach USD 15.16 Billion by 2034

- Functional Coatings Market Volume to Hit 13.14 Million Tons by 2034

- U.S. Diamond Coatings Market Volume to Reach 945.31 Kilo Tons by 2034

- Wood Coatings Market Size to Worth Around USD 20.36 Bn by 2034

Paints and Coatings Market Top Key Companies:

- Jotun

- The Sherwin-Williams Company

- Axalta Coating Systems

- PPG Industries, Inc.

- RPM INTERNATIONAL, INC

- BASF SE

- Henkel AG & Company, KGaA

- Contego International Inc.

- Hempel A/S

- No-Burn Inc.

- Nullifire

- 3M

- Albi Protective Coatings

- Akzo Nobel N.V.

Recent Developments

- In June 2025, PPG unveiled its latest innovation to members of the analyst community at its global coatings innovation center in Allison Park, Pa. The launch represented PPG’s innovation in paints, coatings, and specialty products to improve customer productivity and accelerate organic growth.

- In April 2025, Jotun, a global leader in advanced marine coatings, entered a strategic commercial agreement with Thoresen Shipping Singapore Pte. Ltd., a prominent shipowner operating across Singapore and Thailand, to implement its Hull Skating Solutions (HSS) technology on the bulk carrier Thor Brave. This agreement marks a significant step in accelerating the maritime industry's shift toward proactive hull maintenance and sustainability.

- In January 2025, Axalta Coating Systems and Dürr Systems AG announced a strategic partnership to commercialize digital paint solutions for automotive OEMs by integrating Axalta’s NextJet™ precision paint application technology with Dürr’s advanced robotics systems. The collaboration aims to accelerate the adoption of overspray-free, maskless painting for tutone and vehicle graphic applications, enhancing design flexibility, reducing material waste, and streamlining production efficiency.

- In March 2024, The Sherwin-Williams Company launched Repacor SW-1000, a breakthrough 100% solids, VOC-free coating system designed to streamline maintenance and repair of steel structures, particularly offshore wind turbines and onshore industrial assets. Developed over a three-year R&D initiative, Repacor SW-1000 simplifies application by eliminating multi-layer systems; it delivers full anti-corrosion protection in a single 500-micron coat using a standard sealant gun, without the need for mixing. The coating meets NORSOK M-501 standards, cures four hours faster than traditional aerosol systems, and reduces applicator risk by enabling faster, safer rope-access work with less waste.

Paints and Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Paints and Coatings Market

By Resin Type

- Acrylic

- Waterborne Acrylic

- Solventborne Acrylic

- Epoxy

- Bisphenol-A Epoxy

- Novolac Epoxy

- Alkyd

- Polyurethane (PU)

- Polyester

By Technology

- Water-Based

- Solvent-Based

- Powder Coating

- UV-Cured Coating

- High Solids Coating

By Application

- Architectural Coatings

- Interior Wall Coatings

- Exterior Wall Coatings

- Industrial Coatings

- Automotive Coatings

- OEM Coatings

- Refinish Coatings

- Protective Coatings

By End-Use Industry

- Construction

- Automotive

- Industrial Equipment

- Consumer Goods

- Electronics

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5933

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/